Bank Secrecy stimulates Global Corruption

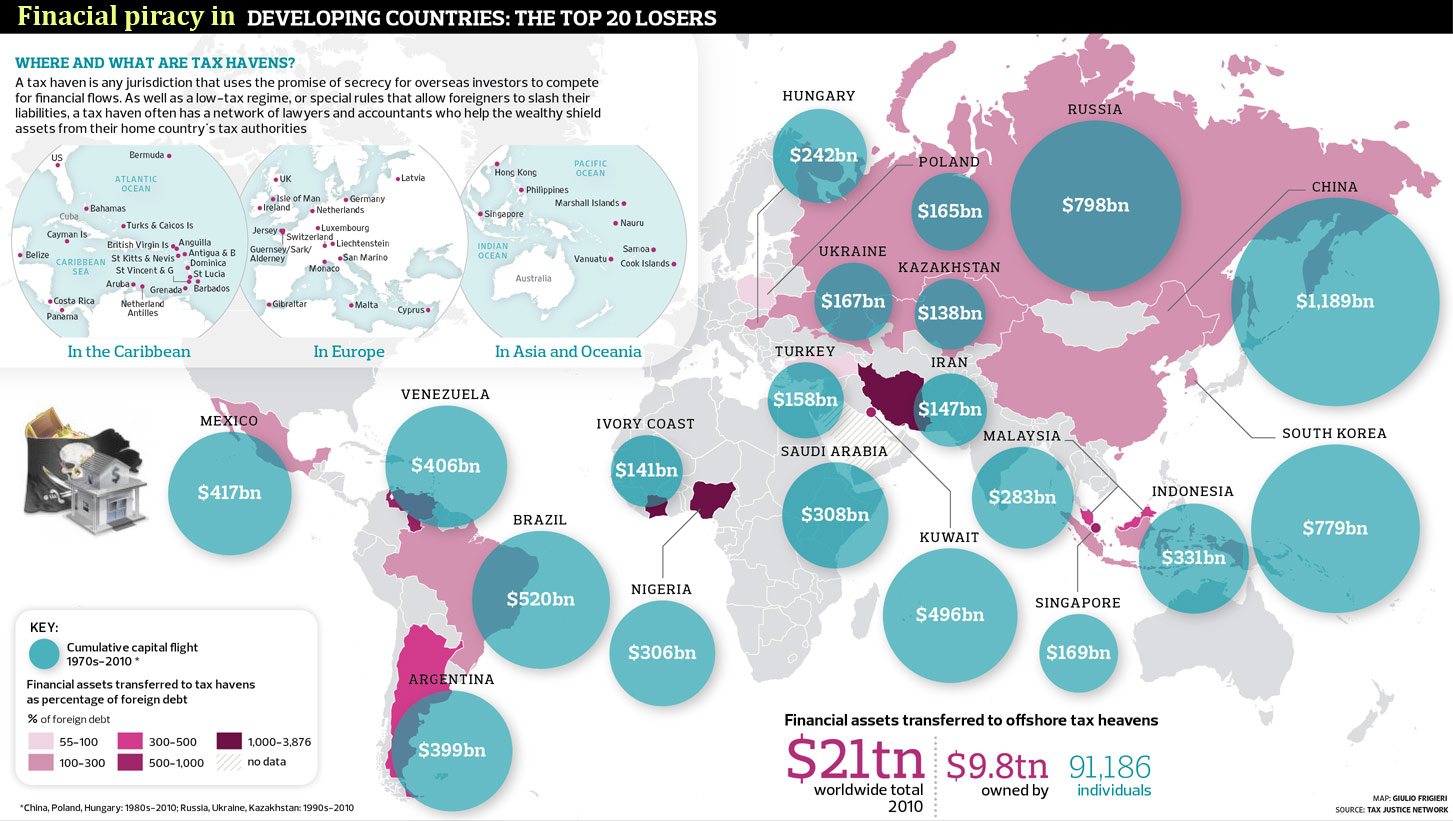

An estimated 25 - 30 % of global wealth is hidden from the world on Tax Havens. Research by the Tax Justice Network estimates that as much as $32Trillion ($32.000.000.000.000) may have been drained and hidden from the world ("Wealth doesn't trickle down, it just floods offshore").

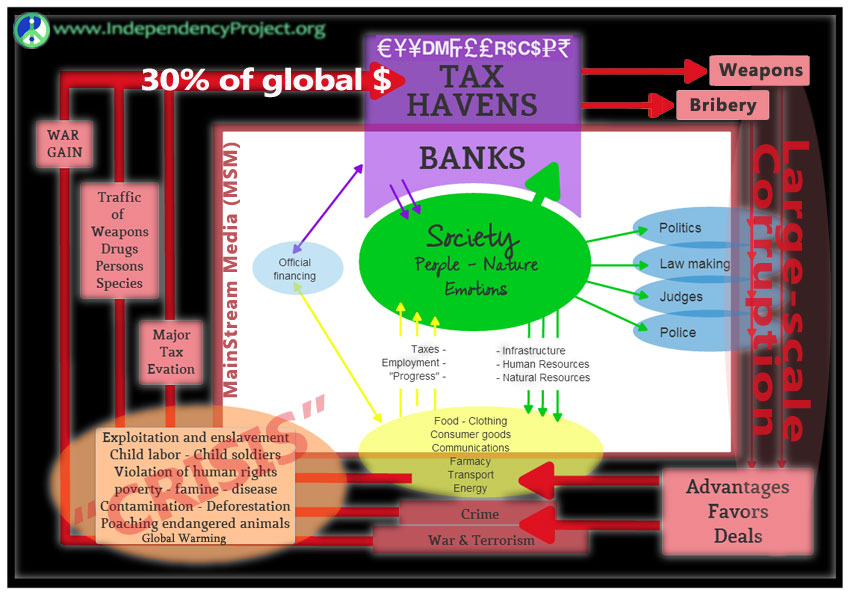

The Bank Secrecy, used by Switzerland and other Tax Havens (Offshore Banking), actually turns them into mere Treasure Islands, where today's financial Pirates keep their Loot. The existence of these Treasure Islands allows for and stimulates large-scale (institutional, corporate, criminal) Corruption which is the one cause, disease if you will, that generates multiple severe effects, or symptoms, like war, crime, injustice, violation of human rights and destruction of natural environment and the planet itself amongst other.

Where does the money come from?

On one hand the Treasure Islands receive an immense incoming flow of capital from two apparently opposed sides:

- large-scale tax avoidance or evation and dubious speculation or other financial enterprises by the legal en generally 'respected' corporations with the help of equally 'respected' commercial banks;

- drug trafficking, human trafficking, extortion, scam, swindle by organized crime.

Both cases if not directly illegal, it is semi-legal at most, but still clearly immoral and unethical. If anyone would deny it, have them explain why then do they feel this need to turn their money black and hide it from society. More than just hiding, it is actually draining wealth out of society, reducing global financial capacity.

The article in the Guardian states that if this hidden money was taxed it would have been enough to solve the Euro crises or put parts of Africa back on its feet. It makes one wonder what could be done with the whole of that money instead of just the taxed part. It is not mentioned in the article. In any case, it is clear that Black Money makes definitely no contribution to global society.

Where does the money go to?

On the other hand, great amount of the capital that is secretly accumulated through illicit activity is also secretly flowing out and spent in possibly even more illicit activities like financing wars, terrorism, weapons and, last but not least, bribery for corruption.

Bribary and corruption are the main elements in all illegal issues.

Only corruption opens the door to breaking laws and rules, which, additionally to the formerly mentioned, also allows any large or small scale criminal get away with it, due to bribes of politicians, law-makers, law-enforcement, lawyers, judges, juries, CEOs, etc.

From wikipedia

A Tax Haven (Offshore 'banking' [- Treasure Island]) is any jurisdiction that uses the promise of SECRECY for overseas investors to compete for FINANCIAL FLOWS, as well a low-tax regime, or special rules that allow foreigners to slash there liabilities (=escape from legal obligations), a Tax Paradise often has a network (army!) of lawyers and accountants (and other related sharks) who help the wealthy shield assets from their home countriy's tax authorities.

From Spiegel Online International

Drugs and other criminal funds are hidden and laundered there, shady deals are arranged, and hedge funds whose speculative activities could shake the financial system once again use them as a base.

As a result, a global shadow realm has developed in the last few decades, with bases on all continents, a parallel economy that escapes all democratic scrutiny, and from which many profit: banks that provide assistance to tax refugees, as well as attorneys and companies that devise sophisticated systems to obfuscate the path the money takes.

The number of tax havens has gone from a handful only a few decades ago to 60, 70 or even more today. Years ago the British Virgin Islands (BVI), Belize, the Cayman Islands, Cyprus and the Marshall Islands were, in some cases, dirt-poor -- until they decided to charge no or almost no taxes on money brought into the country, as well as guarantee the owners of the asset anonymity through company and foundation structures. In return, they collected fees from the offshore companies.

Conclusion

The only conclusion that anyone, who does NOT secretly have any capital hidden on some Treasure Island (the 99%), can draw is that Bank Secrecy and Tax havens are the primary force in destructurizing and destroying society, democracy and justice. By facilitating the laundering of black money, they stimulate greed and perpetuate crime and corruption, that leads to nothing else but war, violation of human rights, destruction of nature and an ever growing gap between the poor and the rich.

The only conclusion is that Bank Secrecy and Tax Havens have to disappear from this planet as soon as possible!

Related links

(yet to be organized/integrated)

- Luxembourg, Cyprus, BVI, Seychelles fail tax transparency rules - OECD

Reuters - Fri Nov 22, 2013 - Financial Secrecy Index 2013

"...the United Kingdom with its satellite secrecy jurisdictions would be ranked first in the FSI by a large margin with a FSI score of 2162 or 3170, respectively (compared to 1765 for Switzerland). Note that this list excludes many British Commonwealth Realms where the Queen remains their head of state."

In other words, the UK essentially "Unites" Tax Havens, time for Scotland to create the first breach! - Bank secrecy masks a world of crime and destruction

- Black money whitening encourages corruption: NHRC

- Wealth doesn't trickle down, it just flows offshore

- How Swiss Bank Accounts Work (some history on bank secrecy)

- Nederland is een topplek voor belastingontwijking (NL)

- http://www.endtaxhavensecrecy.org/

- Trillion Dollar Tax Havens, Inequality and Recession

http://therealnews.com/t2/index.php?option=com_content&task=view&id=33&I... - Bank of Cyprus haircut could reach 60%

- Bank of Cyprus big depositors could lose up to 60%

Bank of Cyprus depositors with more than 100,000 euros (£84,300; $128,200) could lose up to 60% of their savings as part of an EU-IMF bailout restructuring move, officials say. - Cash-starved Cyprus no more tax haven

Finally Cypriots could get into their banks, after two weeks of locked doors. When they reopened, in spite of anger over feelings that their accounts had been held hostage, people were generally calm, Russian television reported on the period of closure. - Shell en ABN Amro hebben meeste postbusfirma's in belastingvrije landen

Grote Nederlandse multinationals maken massaal gebruik van brievenbusfirma's in belastingparadijzen als Bermuda, de Bahama's en de Kaaimaneilanden. De ondernemingen hebben in totaal 237 dochterbedrijven gevestigd in één van de negen belastingvrije landen ter wereld. Shell en ABN Amro hebben veruit de meeste postbusfirma's.

- Log in to post comments

Nederlands

Nederlands Español

Español Italiano

Italiano